Pre-owned jets, piston single aircraft, turboprop aircraft, and Robinson piston helicopters in Sandhills Global marketplaces are exhibiting a mix of value trends according to Sandhills' newest market reports. For example, while inventory levels are up across most categories, asking values for used piston single aircraft are trending sideways while those of used turboprops and piston helicopters are trending down. Jet inventories have been growing since January 2022 and continued to rise in July, but asking values are starting to decline and are trending sideways.

“The recent decrease in used jet aircraft values is especially noteworthy,” says Controller Department Manager Brant Washburn. “But anyone tracking aircraft market trends should be paying attention to the fine points in the new market reports because asking values are responding differently to inventory increases in each category.”

Sandhills’ aviation products include Controller, Controller EMEA, Executive Controller, Charter Hub, Aviation Trader, Aircraft Cost Calculator, and AircraftEvaluator. AircraftEvaluator is Sandhills’ proprietary asset valuation tool for all types of aircraft, built using the same technology behind FleetEvaluator. Widely used and trusted across equipment, truck, and trailer industries, FleetEvaluator identifies asset values with unparalleled accuracy.

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets, as well as model year equipment actively in use.

Additional Market Report Takeaways

This report includes detailed analysis of asking values and inventory trends in used aircraft markets along with charts that help readers visualize the data. It describes and quantifies important trends in the buying and selling of used jet, piston single, turboprop, and Robinson piston helicopter aircraft.

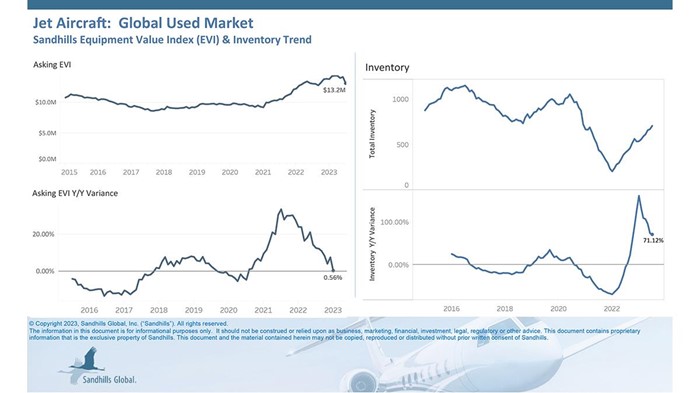

Global Used Jets

Inventory levels of pre-owned jets have been ascending since January 2022, while asking values are starting to trend downwards.

- Inventory levels increased 5.38% M/M and 71.12% YOY in July following consecutive months of increases.

- Asking values decreased 7.23% M/M, rose 0.56% YOY, and are currently trending sideways.

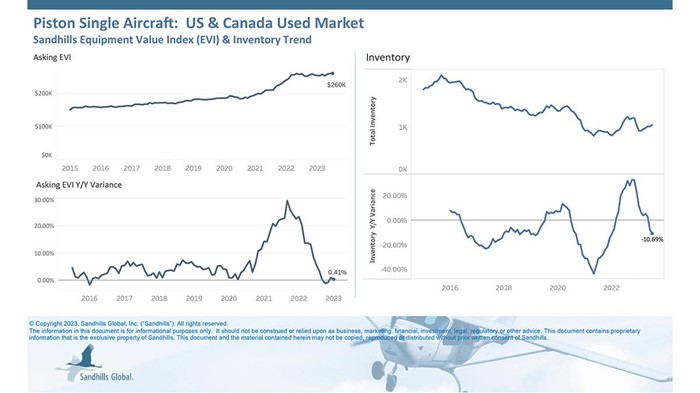

U.S. & Canada Used Piston Single Aircraft

Asking values of used piston single aircraft remain steady and are at a high point while inventory levels have been gaining traction again in recent months.

- Inventory levels rose 3.16% M/M and fell 10.69% in July and are currently trending sideways.

- After numerous months of increases, asking values increased 0.25% M/M and 0.41% YOY.

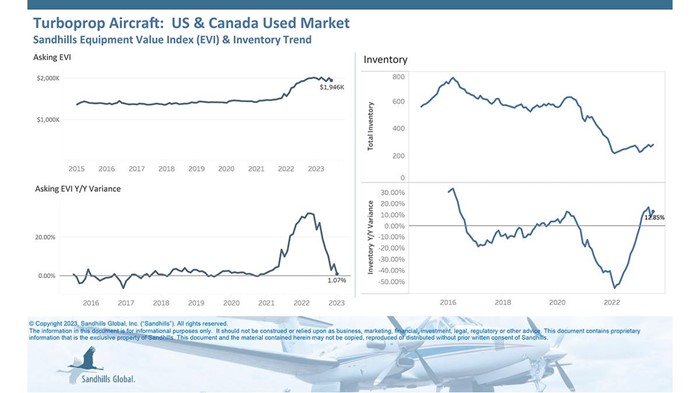

U.S. & Canada Used Turboprop Aircraft

Like piston single aircraft, asking values for used turboprop planes remain steadily at a high point with little change from a year ago. Inventory is slowly increasing and higher than last year.

- Inventory levels gained 5.64% M/M and 12.85% YOY in July and are now trending up.

- Asking values decreased 2.88% M/M and rose 1.07% YOY in July and are currently trending down.

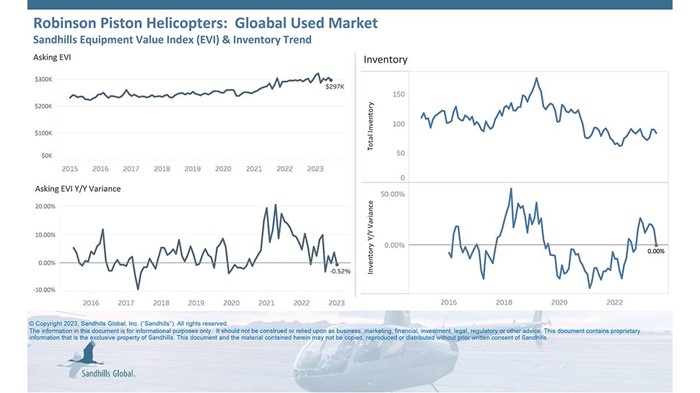

Global Used Robinson Piston Helicopters

Asking values and inventory levels of pre-owned Robinson piston helicopters remained within range during July and are on par with a year ago.

- Inventory levels decreased 6.67% M/M and posted a 0.00% YOY gain in July and are trending sideways.

- Asking values fell 3.01% M/M and 0.52% YOY and are currently trending down.

Obtain The Full Reports

For more information, or to receive detailed analysis from Sandhills Global, contact us at marketreports@sandhills.com.

About Sandhills Global

Sandhills Global is an information processing company headquartered in Lincoln, Nebraska. Our products and services gather, process, and distribute information in the form of trade publications, websites, and online services that connect buyers and sellers across the aviation, construction, agriculture, and commercial trucking industries. Our integrated, industry-specific approach to hosted technologies and services offers solutions that help businesses large and small operate efficiently and grow securely, cost-effectively, and successfully. Sandhills Global—we are the cloud.

About The Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, commercial trucking, and aviation industries represented by Sandhills Global marketplaces, including Controller.com, AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator and AircraftEvaluator, Sandhills’ proprietary asset valuation tools, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.

Contact Sandhills

www.sandhills.com/contact-us

402-479-2181

Posted On: 8/7/2023 1:13:55 PM